Every Once In A While The Media Will Blow Up A Story About Insider Trading…

The most recent large scale one was Nancy Pelosi’s trades back in December of last year.

A New York Post article was written about it here as well. Here’s the thing, today we are not going to debate over whether it is possible to use inside trades to beat the market. We know that we can, thanks to some in depth research by u/nobjos of Reddit and author of Market Sentiment. Over the course of one year insider trades outpaced the S&P 500 by 17.6%.

So then what ARE we discussing today?

What Is The Method By Which We Can Follow Insider Trades Effectively?

Insiders might sell their shares for any number of reasons, but they buy for only one: they think the price will rise - Peter Lynch

The first thing we need to know is that insiders are required to disclose their trades. When they do so is a matter of their relation to the company, current ownership, or political office. In particular we are looking at trades by politicians. According to the STOCK Act of 2012 politicians are required to file any stock, bond, or other securities transaction within 45 days of the trade taking place. This gets filed as a “Periodic Transaction Report.”

The official databases for politicians stock trades can be found here for Representatives and here for Senators.

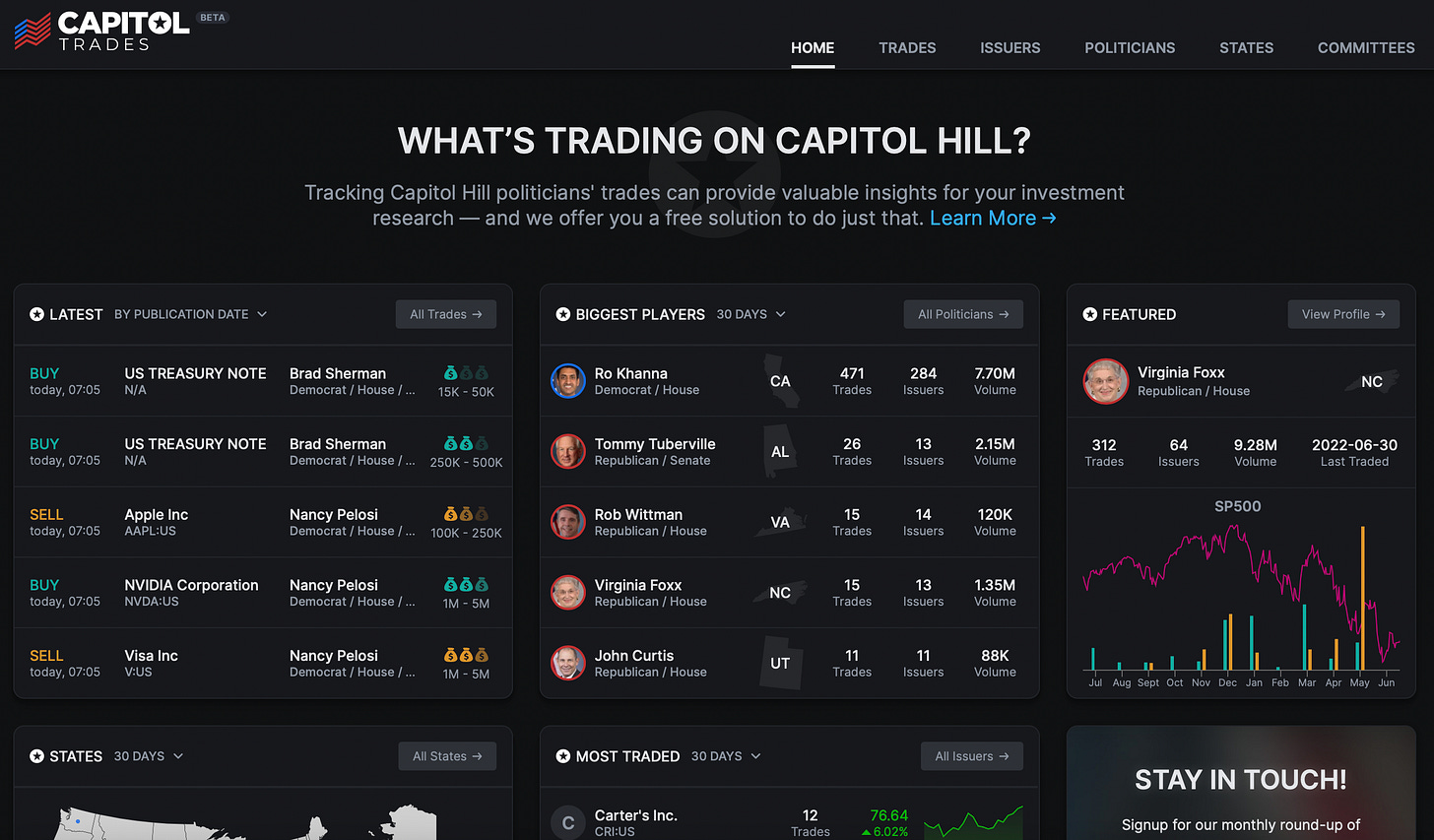

However, this is not really the best way to look for politicians’ stock trades. Government websites are not really well known for their cutting edge features which is why there is alternative tools like capitoltrades.com this tool allows you to search by politician, political party, stock tickers, market cap, trade size, etc.

By far this is probably the most comprehensive tool out there for checking on politicians’ stock trades. If you want to get notification for stock trades they also have a twitter page where they release select politician trades.

Not only that, but there is also a website called Quiver Quant with prebuilt strategies based off of Congress trades that gives info like Sharpe ratio, and CAGR.

Also, I find it important to note what the traffic is on these websites. After all, the less people that see them the better off we are, the market really has a way of killing your alpha once too many people hop on the bandwagon.

For reference, large financial sites like finviz.com and marketwatch.com receive millions of page visits every month.

Quiver Quant and Capitol Trades by comparison receive far fewer visits, which is good for us.

These sites receive only a tiny 2% of the monthly traffic that finviz.com gets!

Again, this is a good thing for us, as we talked about in a previous post, less eyeballs = less liquidity = higher returns.

Returning To Pelosi…

When I saw that post in r/wallstreetbets referenced at the beginning of this post for the first time my immediate thought was this can’t be good. That set of trades had not only been widely publicized on Reddit, but also in mainstream media. This generally is not a good indicator for returns on a stock (aside from the bear market we’ve entered since the beginning of the year) because the information gets priced into the share price much faster. Ideally what we would be after is a set of trades from a politician that have received very little media coverage. For Nancy Pelosi in particular, that might be a bit tricky considering that she gets covered by major news outlets on a regular basis. In fact here is a set of trades publicized less than a day ago from the time of this writing.

But just for fun, let check to see how this set of trades would have done. We won’t get exact mirror results of what happened to these positions since all of the trades made were option trades, but we can get a general idea of how they performed.

As we can see the portfolio only consists of 5 companies (and 1 private company).

The results don’t make it look too good.

Since the trade was made, the portfolio has experienced twice the drawdown of an S&P 500 index fund. Considering that the actuality of these trades were option plays, that -40% drawdown is mostly likely much larger than portfolio visualizer would indicate.

However there is another factor at play here, Nancy’s net worth is estimated to be over $100 million. All of these option trades combined only make up 3.5% of her total net worth.

It would be safe to say that this wasn’t a “YOLO” or constitute a sizable chunk of her portfolio. It appears that Nancy makes lots of tiny bets with options with the hope that the diversification provides here with some big winners here and there.

If it were me, this is the route I would take. I would match her position sizing scaled down to the size of my portfolio.

Another thing to note is that all of these trades are called “LEAPS.” LEAPS stand for Long Term Equity Anticipation Securities, essentially they are just options with really long dated expirations. This reduces the amount of time value decay (theta) they experience with the tradeoff of being very expensive (in both just straight dollars and in terms of their possible ROI).

While a particular stock may run up 50-100% in one or two years LEAPS magnify those gains into hundreds of percent. In the trades that we looked at from January though, we can also see that there is a good possibility that they also crater 80-90% in value.

But Aren’t You Missing Something? By The Time Politicians Disclose Their Trades It’s Too Late To Invest!

Actually no it’s not.

If we take a look at Market Sentiment’s research again we can see that the bulk of the returns happen from 6 months to 1 year out.

There are instances of politicians reporting their trades incredibly late in violation of the STOCK Act, except it is not incredibly common.

With that said, that’s all we have for today! Do you have any experience following insider trades? Leave a comment below or shoot me an email! Also, these articles take many hours of work and research, so if you could subscribe or refer a friend I would really appreciate it!

All content is for discussion, entertainment, and illustrative purposes only and should not be construed as professional financial advice, solicitation, or recommendation to buy or sell any securities, notwithstanding anything stated.

There are risks associated with investing in securities. Loss of principal is possible. Some high-risk investments may use leverage, which could accentuate losses. Foreign investing involves special risks, including a greater volatility and political, economic and currency risks and differences in accounting methods. Past performance is not a predictor of future investment performance.

Should you need such advice, consult a licensed financial advisor, legal advisor, or tax advisor.

All views expressed are personal opinion and are subject to change without responsibility to update views. No guarantee is given regarding the accuracy of information on this post