Using LEAPs to Double Down

Downturns are the best time to double down, but how do you do that when credit is tight?

Welcome back everyone to this weeks edition of Premium Income Investments! This week we’ll be covering the use of leverage which, if you’ve read my past articles you’ll know I’ve already covered the topic of leverage a lot.

But today I’m particularly concerned with how we can effectively utilize leverage in a downturn like we are currently. Margin rates and requirements have shot up significantly from where we were even a couple months ago.

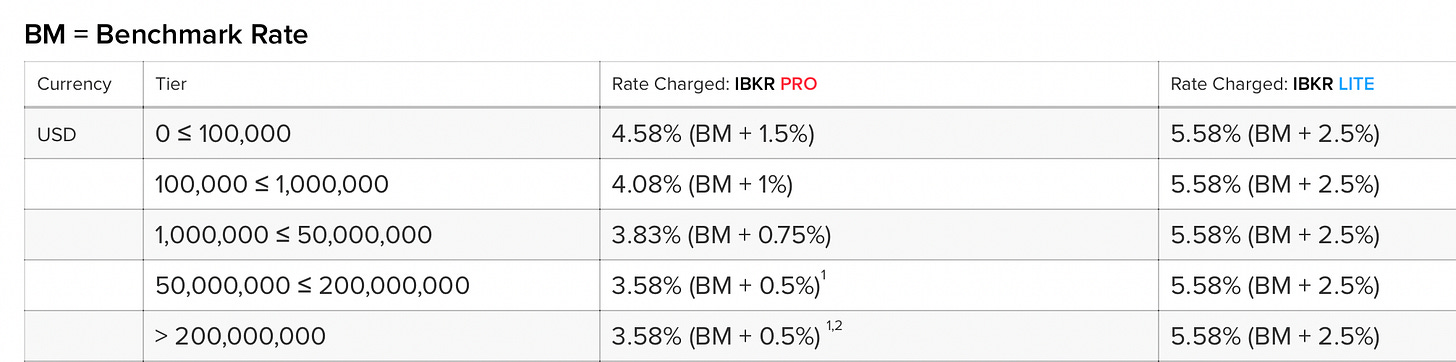

Interactive Brokers who are specifically known for having the best margin rates currently have their rate set at just over 4% even with over 200 million in an account.

It’s pretty apparent that higher interest rates and harder margin requirements are not a good thing for investors that use leverage as a key component in their strategy.

So what to do…

That’s where LEAPs come in. LEAPs, also known as Long-term Equity Anticipation Securities are deep in the money options which are used to make directional bets on a stock. These generally have one to three years left until their expiration meaning that much less of their time value is eroded than a shorter dated option. However, they can come with crazy triple digit returns given a sufficient trending market.

LEAPs have less risk than short dated out of the money options, but still more risk than purchasing shares outright. This makes them an ideal candidate for increasing our risk and leverage without turning to outright speculation.

If you’re still unsure or want a deeper understanding about how LEAPs can help us I would highly recommend taking a look at this video.

How do we calculate how many LEAPs we need though?

This question is a little bit tricky at first given that LEAPs actually do not borrow money to increase leverage. However by taking a look at the option greeks we can get a better picture of the leverage of any given LEAP. The formula for calculating this is:

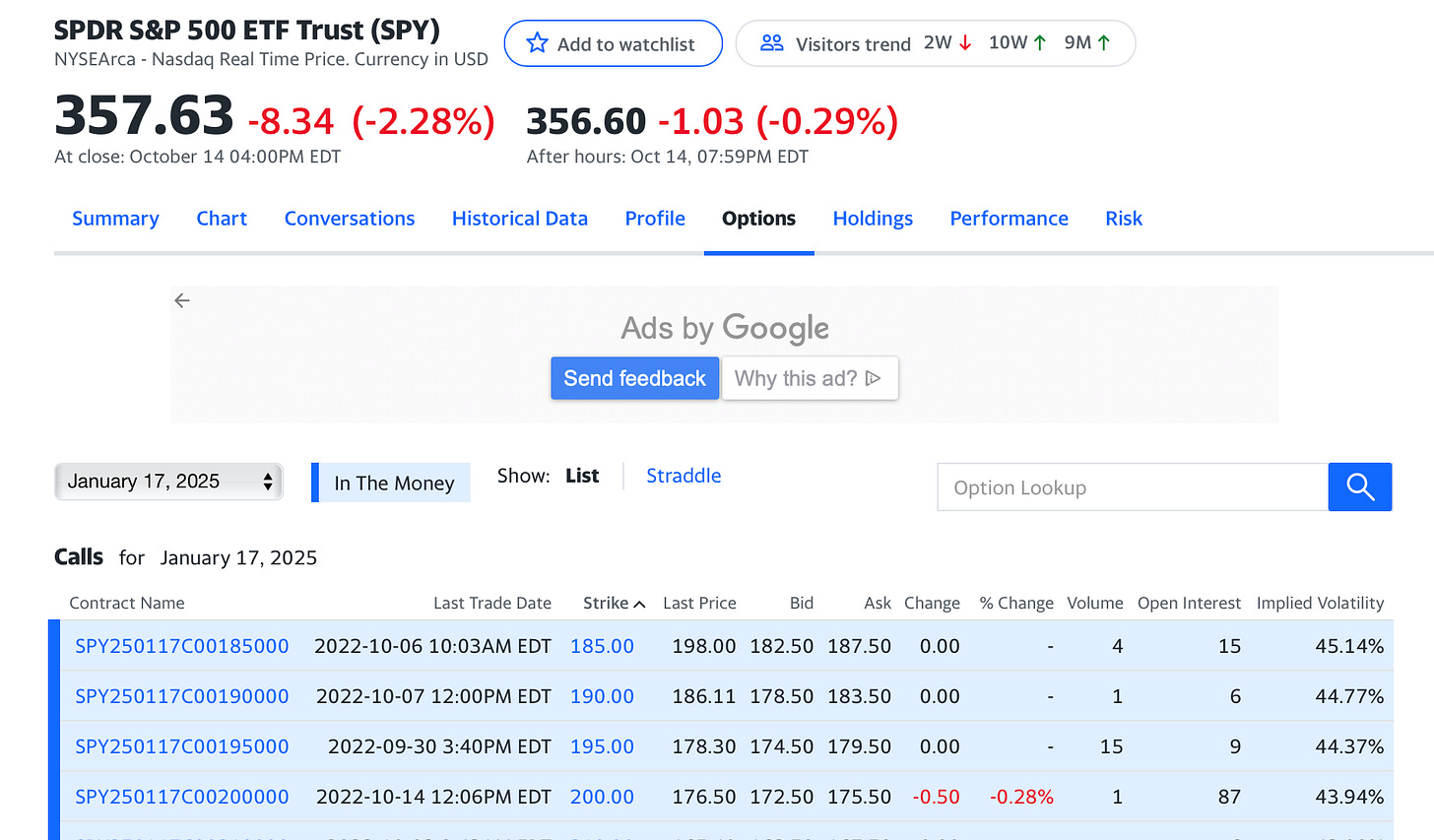

(Delta Value of Option * Price of Underlying Security) / Price of OptionIf we take a look at SPY we can apply this fairly easily.

Getting the delta value for the January 17, 2025 $185 Call option gives 0.9527 (value obtained through my brokerage). So now its as simple as:

(0.9527 * $357.63) / $198.00 = Leverage ratio of 1.72Then to determine how much of an effect this leverage would have on our portfolio we can just weigh the individual components of our portfolio. For example if 90% of our portfolio is directly in SPY and 10% is comprised of these specific LEAPs we could calculate our total portfolio leverage as:

[(1.0 * 90%) + (1.72 * 10%)](Note “1.0” is the leverage ratio of our SPY portion since 1.0 means zero leverage)

This calculation leaves us with a hypothetical 1.172 leverage ratio. In other words, if we had $100k it would be as if we had borrowed an additional $17,200.

Overall this is a simplified process of how it would be done in reality where you would need to calculate the leverage ratio regularly in order to rebalance your portfolio. But the principle is the same.

And always remember, shares expire far less than options, be wary of your leverage!

If you enjoyed today’s article please consider sharing it with a friend! It really helps me out to continue making quality content.

Thanks again for reading! And I will see you all again in the next post!

Until Next Time!

All content is for discussion, entertainment, and illustrative purposes only and should not be construed as professional financial advice, solicitation, or recommendation to buy or sell any securities, notwithstanding anything stated.

There are risks associated with investing in securities. Loss of principal is possible. Some high-risk investments may use leverage, which could accentuate losses. Foreign investing involves special risks, including a greater volatility and political, economic and currency risks and differences in accounting methods. Past performance is not a predictor of future investment performance.

Should you need such advice, consult a licensed financial advisor, legal advisor, or tax advisor.

All views expressed are personal opinion and are subject to change without responsibility to update views. No guarantee is given regarding the accuracy of information on this post