Welcome Back Everyone!

It’s been a little while since I’ve been able to make a post, but I’m hoping that with some new changes to my schedule we can get right back into the grove of things with one article a week.

This week I want to tackle a topic suggested to me by a subscriber a while back. It’s something I’ve danced around for awhile so it might sound somewhat familiar to the conclusions of my past articles.

So what specifically is it?

Fama French Five Factor Investing.

Essentially, five factor investing posits that the return of a portfolio is the result of five different factors: beta, size, value, profitability, and investment. According to their research, these five factors accounted anywhere from 71% to 94% of expected returns. We’ve touched on these factors in previous articles but just as a recap, beta is the volatility difference between the current portfolio and the overall market. Size is exactly what it sounds like, it correlates return based on the size (market cap) of a company. Value is based on how “expensive” company is using price to book or book to market metrics. Profitability looks at the operating margins of company and how it affects returns, and finally investment looks at how much the company reinvests into itself to make its operations or services better.

So by performing a Fama French analysis on our portfolio we can account for most of the return profile. However, based on factor analysis the general consensus is that value and small size carry the largest return premium. Whether these two factors are considered as increased risk or alpha is still hotly debated.

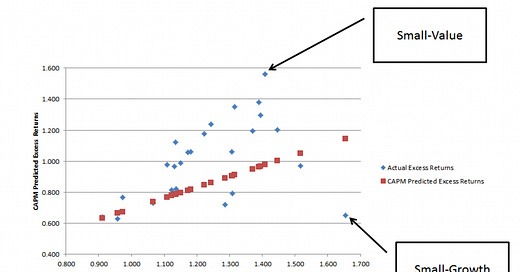

Overall, the Fama French portfolio is still much better than the alternative Capital Asset Pricing Model (CAPM) which was invented in 1964 and only used one factor to explain returns, beta.

As you may be able to tell, beta alone is only able to give the general trend of returns, but not with any degree of accuracy for a given portfolio. Both the small value and small growth portfolios deviate heavily from the predicted excess return.

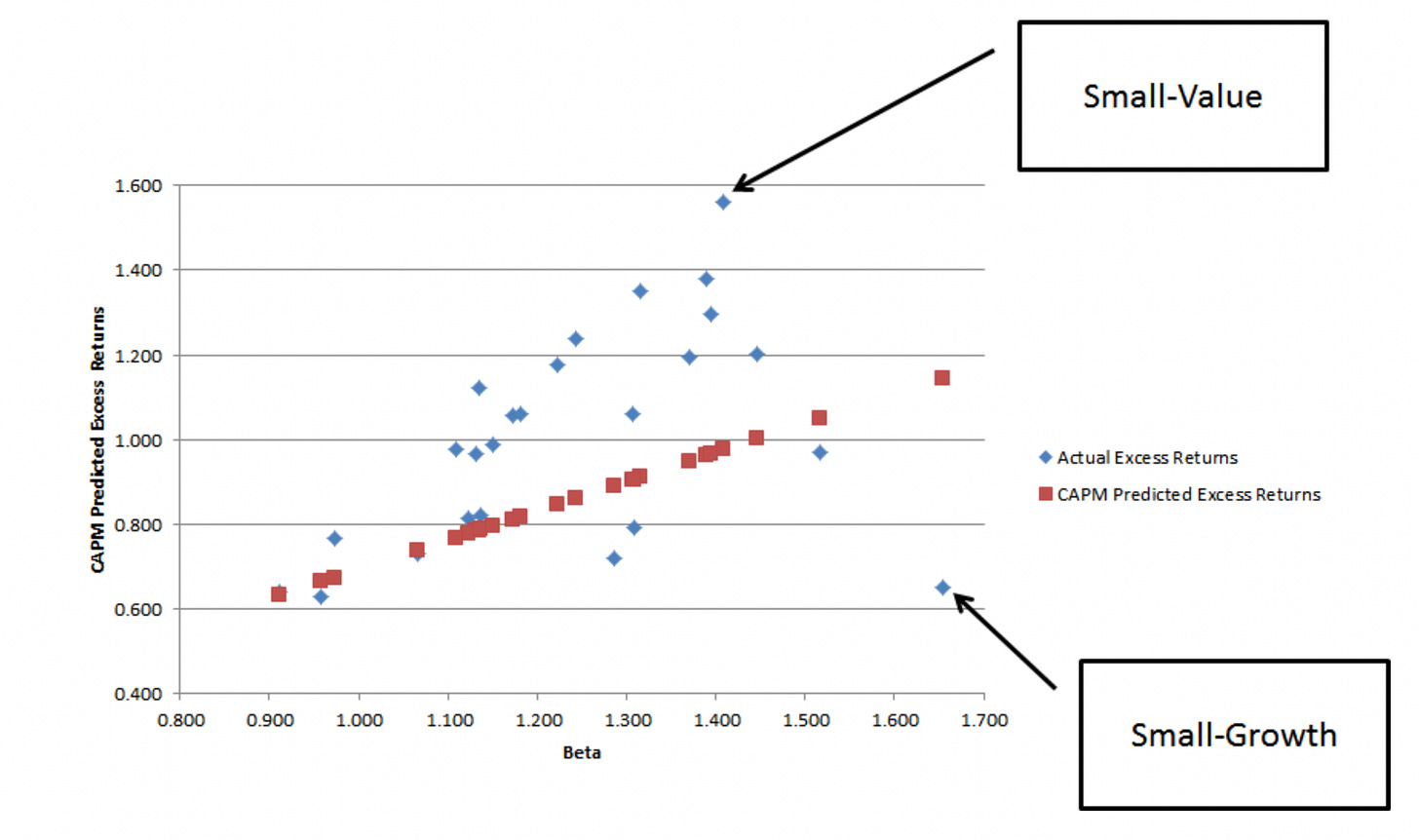

With the five factor portfolio there is a much better picture of the return profile because more of the relevant factors that affect the return of a stock are taken into account. For example when using an equal weight portfolio of all companies contained in the NYSE, AMEX, and NASDAQ the CAPM and the Fama French model come out with two very different answers. (Note: the factor model used for the following image uses only three, not five factors.)

With factor investing, it is much less likely that the expected return from a given portfolio will be overestimated or underestimated.

So What Does This Mean For Us?

The way I see it there is really two things this means for us.

There are quantifiable factors that we know can affect our return profile in a positive way (value and size).

Finding something that we can actually use to generate alpha is HARD. Something we already knew…

The good news is that if you want to eek out a few extra percent return every year (or a fraction of a percent) there is a simple and easy way to do so. Invest in small value companies. If you combine that with lifecycle investing, you could probably pump up your returns even more.

The bad news is that since 71-94% of expected returns are accounted for in factor investing, it is much less likely that we find a strategy that generates “true alpha” in essence, a free lunch. That’s not to say that there is not something out there that exists to increase returns, just that they are few and far between. Not to mention, in the past when these “edges” have been revealed they often become overused to the point that the alpha generated by them disappears.

With that said, we will keep looking, so stay tuned!

I hope you have great rest of your week and…

Until Next Time!

All content is for discussion, entertainment, and illustrative purposes only and should not be construed as professional financial advice, solicitation, or recommendation to buy or sell any securities, notwithstanding anything stated.

There are risks associated with investing in securities. Loss of principal is possible. Some high-risk investments may use leverage, which could accentuate losses. Foreign investing involves special risks, including a greater volatility and political, economic and currency risks and differences in accounting methods. Past performance is not a predictor of future investment performance.

Should you need such advice, consult a licensed financial advisor, legal advisor, or tax advisor.

All views expressed are personal opinion and are subject to change without responsibility to update views. No guarantee is given regarding the accuracy of information on this post