The Right Way To Diversify

Diversification is protection against ignorance, but if you don’t feel ignorant, the need for it goes down drastically — Warren Buffett

Welcome back everyone! Hope you had a great week and are looking forward to another edition of Premium Income Investments.

This week I want to dive into something that nearly every good investor does with their portfolio, but on a bit deeper level.

Diversification

Diversification according to Nobel prize winner Harry Markowitz “is the only free lunch in investing.”

Instead of making a tradeoff of risk for reward, you actually are able to mitigate risk without hurting your return! Why does this happen? Simple really, when you diversify the probability of you buying investments with less than 100% correlation is high. When correlation is less than 100% than we know have two investments that move independently of each other.

If one investment gains in value the other may also gain in value, stay flat or drop in value. Essentially it just means that the two investments will move differently from each other most of the time. (This is different from an inverse correlation in which one investment will move exactly inverse of the other one).

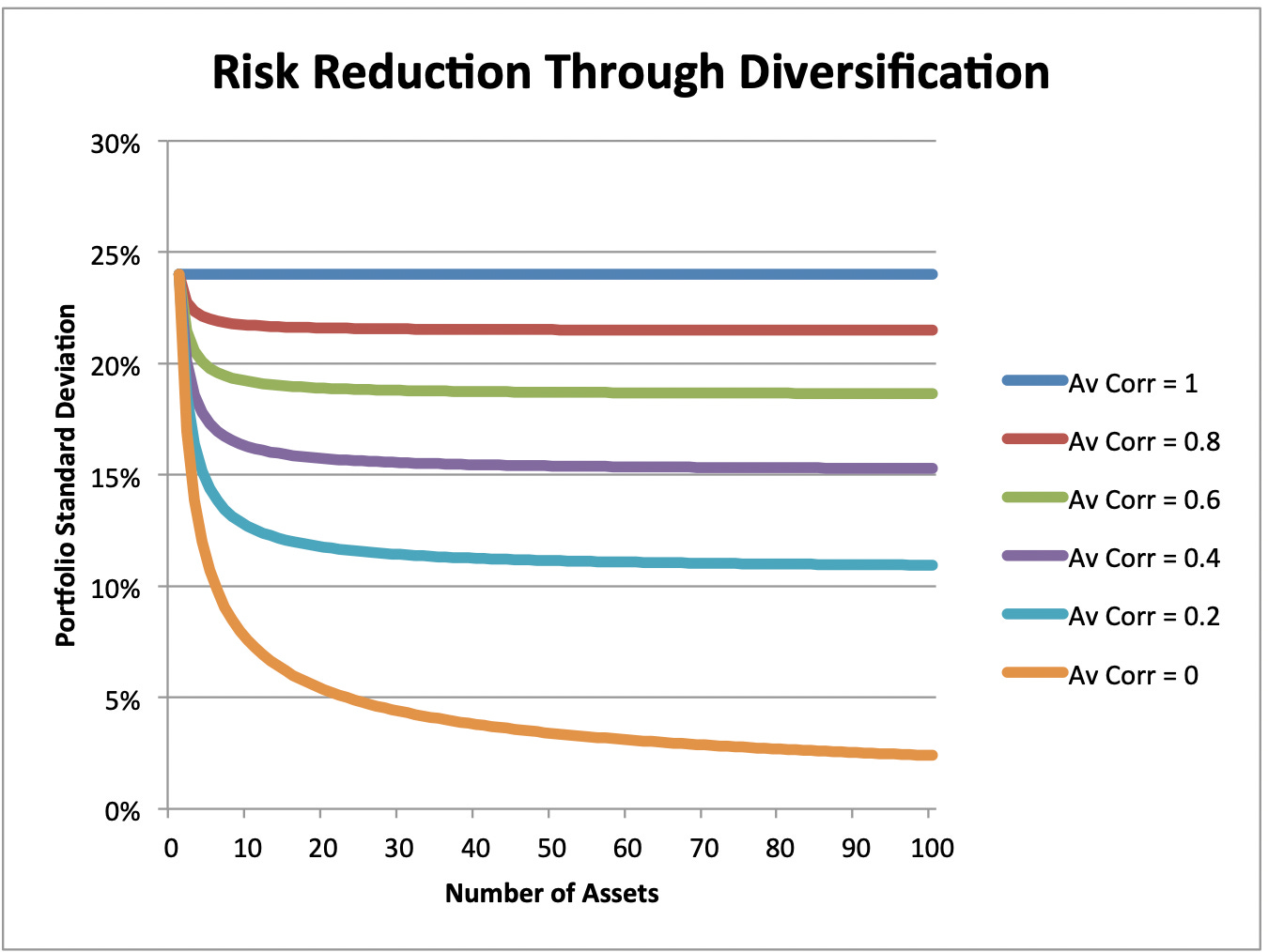

In effect we can take advantage of this by investing in many different stocks which explains this chart.

But if you pay attention, you can see that there is a diminishing return on diversification. Warren Buffett sums this up perfectly with the quote mentioned at the beginning of this post. With most of the portfolios shown here the benefit from diversifying drops off to almost negligible levels after about 10-20 stocks.

That brings us to the second observation. The difference between these portfolios is only the correlation of their components. As you can see, the effect of diversification changes with the average portfolio correlation. A higher correlation results in a steeper drop off in benefits from diversification, whereas a lower correlation (such as the orange line) has a much more gradual diminishing effect.

Ultimately, we can find equities that are relatively uncorrelated to each other without leaving the stock market, which is why a lot of people turn to large indexes such as the S&P 500 or the Dow Jones. However, even this does have its limit.

For example if we use this stock correlation tool we can find that Tesla and Procter and Gamble (arguably about as different of companies as you can get) have a 0.86 correlation with each other.

This should be fine if we are okay with the average standard deviation/risk level of investing only in equities. However, if we wanted to reduce our standard deviation even more, we would need to turn to different asset classes.

This is where a chart like this comes in handy. Using this we can find asset classes such as REITs which can get us below a 0.70 correlation with the S&P 500.

Personally, this is part of the reason why I am a fan of REITs in particular, but as shown by the chart there are other asset classes or investment vehicles that have similar correlations.

This is a handy thing to keep in your back pocket as you search for market beating strategies to pursue which is why I figured I would share it today. After all, why shouldn’t we take advantage of one of the only guarantees that the market gives us?

Anyway, that about wraps it up for today! If you have any questions or comments please don’t hesitate to drop them below and I would be more than happy to converse with you! Wishing you all a good rest of your Sunday and the week ahead!

All content is for discussion, entertainment, and illustrative purposes only and should not be construed as professional financial advice, solicitation, or recommendation to buy or sell any securities, notwithstanding anything stated.

There are risks associated with investing in securities. Loss of principal is possible. Some high-risk investments may use leverage, which could accentuate losses. Foreign investing involves special risks, including a greater volatility and political, economic and currency risks and differences in accounting methods. Past performance is not a predictor of future investment performance.

Should you need such advice, consult a licensed financial advisor, legal advisor, or tax advisor.

All views expressed are personal opinion and are subject to change without responsibility to update views. No guarantee is given regarding the accuracy of information on this post