I’m sure that if you are plugged into various investment communities at some point or another you have heard of something called dividend investing.

Dividend investing is as simple as it sounds. Investors invest for the primary purpose of receiving dividends. They generally worry less about the appreciation of the stock since the idea is that once they acquire enough shares, their dividends will be able to fund their lifestyle instead of periodic stock sales.

Of course, there are a lot of stocks out there that issue incredibly high dividends which are unsustainable for the long term (like $ZIM). To weed out these companies that would make good long-term dividend stocks they follow a couple key principles.

Invest in quality companies. A company needs to be fundamentally sound. This is generally just a good investing principle that applies to more than just dividend investing.

They look for dividend aristocrats or dividend kings. These terms refer to how long a company has been paying a dividend and increasing it year over year. Aristocrats have increased the dividend for at least 25 years and kings have increased the dividend for at least 50 years.

These principles guide them towards companies with higher than average yields and more often than not, household name recognition.

Some of the more popular dividend investments are Kelloggs, Ford, Apple, Altria Group, and Clorox.

But The Real Question Is, How Optimal Is It To Invest Like This?

If we compare the returns of dividend investing to simply investing in a total market or S&P 500 fund would we be ahead or behind?

Is there actually a performance advantage to following dividend investors?

Let’s take a look.

To start with a simple comparison, we will use a total market fund vs SCHD. SCHD is an index fund that contains well regarded dividend stocks in the US.

The total market fund (VTI) has an annual dividend yield of 1.41% while SCHD comes in at over twice that with a 3.26% yield.

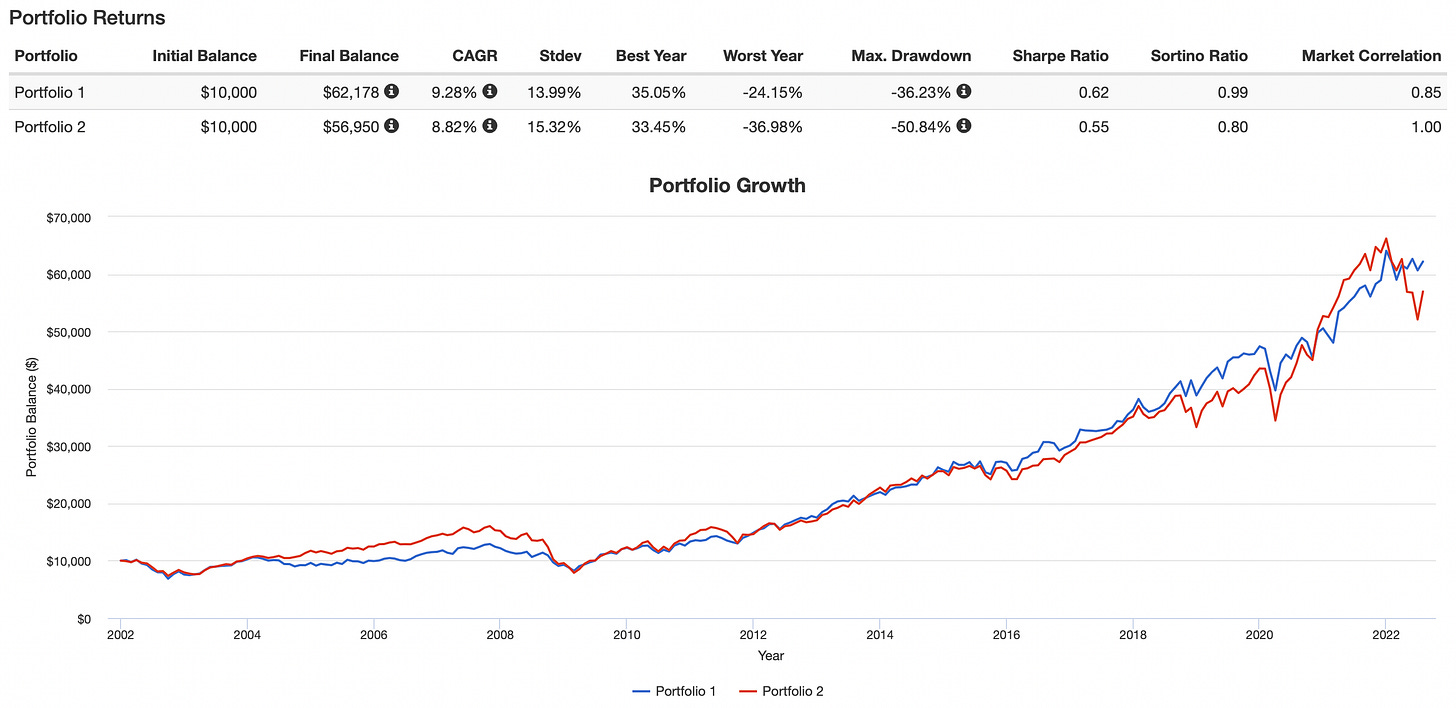

If we take a look at the two funds on portfolio visualizer we find that SCHD has managed to outperform VTI (barely) since its inception in 2012.

You may also notice that the Sharpe ratio is higher for the dividend fund than for the total market fund. This is really good because it means that for a given level of risk (volatility) that we are taking, we make more return on our investment.

So case closed then, dividend investing for the win. Right?

Not so fast. If you’ve paid close attention you’ll notice that the backtest results only go back to 2012.

This is only ten years of historical data. Data that I would argue is heavily biased towards an extreme bull market. With this in mind, it’s difficult to create a full picture on this fund in particular.

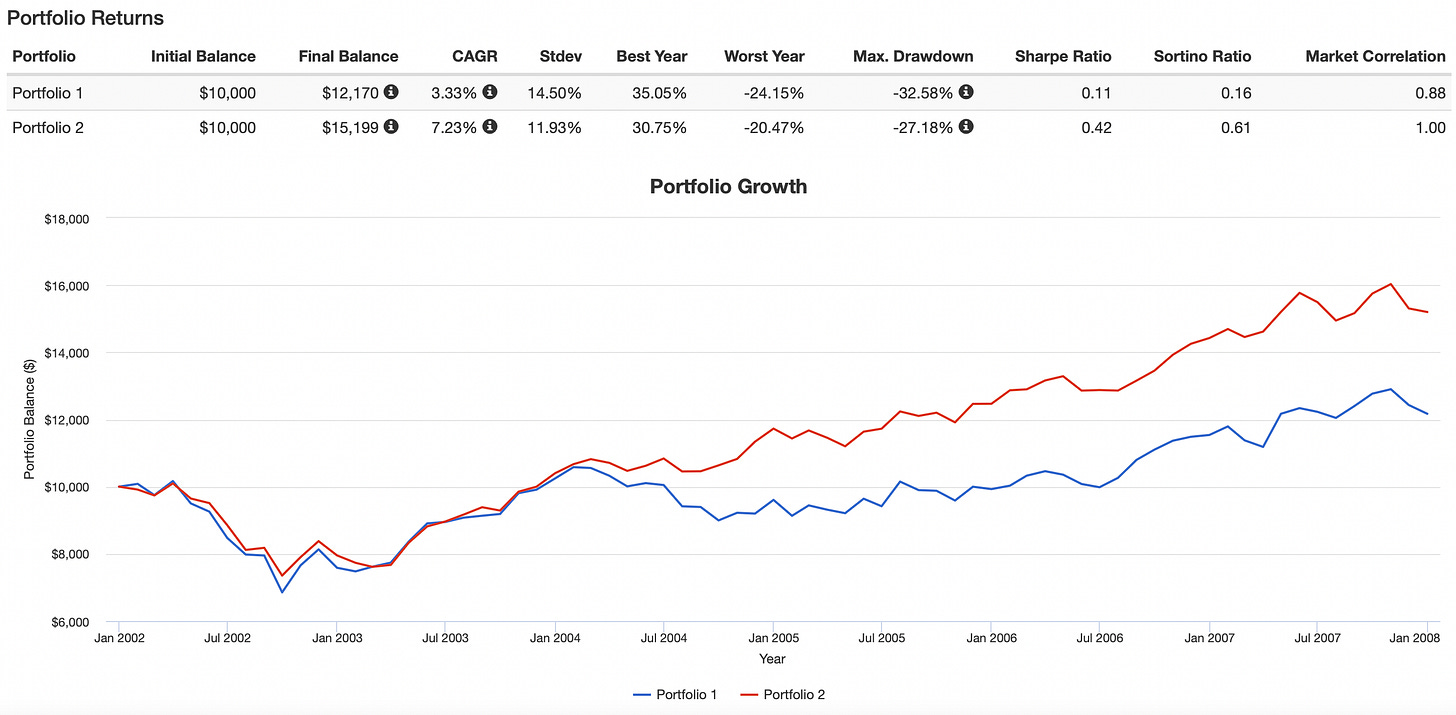

Luckily, we can find the underlying holdings of this fund fairly easily. If we pick their nine largest holdings, we can backtest the data much further.

Now our data goes back an additional ten years, which is highly valuable because it puts us through the lost decade (2000-2010) with no real return.

Strangely enough, we notice here that there is also an outperformance with the dividend portfolio. Not only on a total return basis but also on a risk adjusted one.

Granted, there is far less diversification in this portfolio, but even with that we can see that the standard deviation is still a full percentage point lower than the total market fund.

However, I don’t think it is really fair to pick one time period and extrapolate an investment decision from it. So, like in some of my previous articles, I’m going to pick several time frames so we can see a more complete picture.

Here is our first snapshot from 2002-2007.

Our performance over this time period is incredibly lackluster. This is not what I would have expected given the value/dividend bias inherent to the portfolio.

On the other hand though, the next five years of performance are completely swapped.

While the last five year period contained two downturns (2002 and the beginning of the GFC in 2007) this period caught only the tail end of the Great Financial Crisis. After that it was mostly smooth sailing with a great bull market.

It appears that the dividend stocks managed to outperform during the bull run period as opposed to the flat market in the early-mid 2000s.

From 2012 onward to 2017 the performance of both portfolios look very similar.

It would make sense though, given the fact that there was very little turbulence in the markets after 2011 or so until 2018.

One key thing to note here however, the Sharpe ratio of our dividend portfolio is lower, even though our total return is higher. (This is important because we can always leverage up a lower return portfolio to beat a higher return portfolio with less risk if the Sharpe ratio is lower.)

Our final period is from 2017 to the present.

Again, here we see an outperformance by the dividend portfolio, not only just on total returns but also on risk adjusted returns.

In my personal opinion I think that this last five year period has been the most crucial in explaining the dividend portfolio outperformance. By moving back just five years our total excess return over the total market fund drops in half.

Even with this considered, it seems as though dividend investing comes out on top.

However…

There is still one thing that we have not talked about which is highly crucial to dividend investing to keep our outperformance.

In this world nothing is certain except death and taxes.

- Benjamin Franklin

That’s right, everyone has to pay the tax man at some point, and some investing styles get hit harder by the tax man than others.

Dividend investing in particular can be highly susceptible to being taxed due to the ordinary distributions made to shareholders.

There are two types of dividends, qualified and non-qualified. Qualified dividends allow for the preferential long term capital gains tax which as of this writing tops out at 20%.

Unqualified dividends are the exact opposite and get taxed as normal income (37% at the highest bracket).

Fortunately, most dividend stocks that dividend investors are proponents of qualify as “qualified dividends.”

A U.S. company

A company in U.S. possession

A foreign company residing in a country that is eligible for benefits under a U.S. tax treaty

A foreign company’s stock that can be easily traded on a major U.S. stock market

Meet a holding period requirement.

Although, even with this preferential tax treatment, you still get taxed even if you reinvest your dividends!

This does not matter if you were planning on spending the money anyway, since you would incur capital gains tax on a stock sale as well, but for someone in the accumulation phase of building wealth, this could be a significant drag on returns.

Say we have “Investor A” who puts their money into an investment that appreciates at 10% a year. “Investor B” instead puts their money into an investment that appreciates at 6% a year and pays a 4% annual dividend.

On the surface it would appear that both come out the same since they make 10% compounded returns. But this is not actually the case after accounting for taxes.

On the 4% annual dividend “Investor B” is getting taxed (at most) 0.8% even if he reinvested.

Meaning that "“Investor B” would have to make a higher return just simply due to the tax drag!

The One Consolation:

If instead of investing through a regular taxable account, the dividend investor invests through a tax advantaged account, only then can they see the same after tax performance as the non dividend investor (given the same pre-tax returns).

An IRA, Roth IRA, or 401k are all common tax advantaged accounts that can be used to take advantage of this. If one of these accounts is used, the dividend investor does not have to pay taxes on their dividends unless they are pulled out of the account to be spent.

This is very key with dividend investing! If you do not invest in a tax advantaged account, you are literally burning your money that you could have used otherwise.

With that said, I hope that this was an informative and interesting article. If you thought so, please like this post and consider subscribing. I only send one post a week so I promise I won’t be spamming your inbox with promotions. And the best part? It is completely free!

If you find that too much of a commitment, I completely understand. But I would ask that you could help me by referring one friend to this post through my referral program. It just takes a couple clicks and you could win a personal Q&A session with me!

It will ask you for your email so that I can keep track of your referrals, but you will not receive any emails from me through this.

Thank you so much for reading, and I will see you all next week!

All content is for discussion, entertainment, and illustrative purposes only and should not be construed as professional financial advice, solicitation, or recommendation to buy or sell any securities, notwithstanding anything stated.

There are risks associated with investing in securities. Loss of principal is possible. Some high-risk investments may use leverage, which could accentuate losses. Foreign investing involves special risks, including a greater volatility and political, economic and currency risks and differences in accounting methods. Past performance is not a predictor of future investment performance.

Should you need such advice, consult a licensed financial advisor, legal advisor, or tax advisor.

All views expressed are personal opinion and are subject to change without responsibility to update views. No guarantee is given regarding the accuracy of information on this post