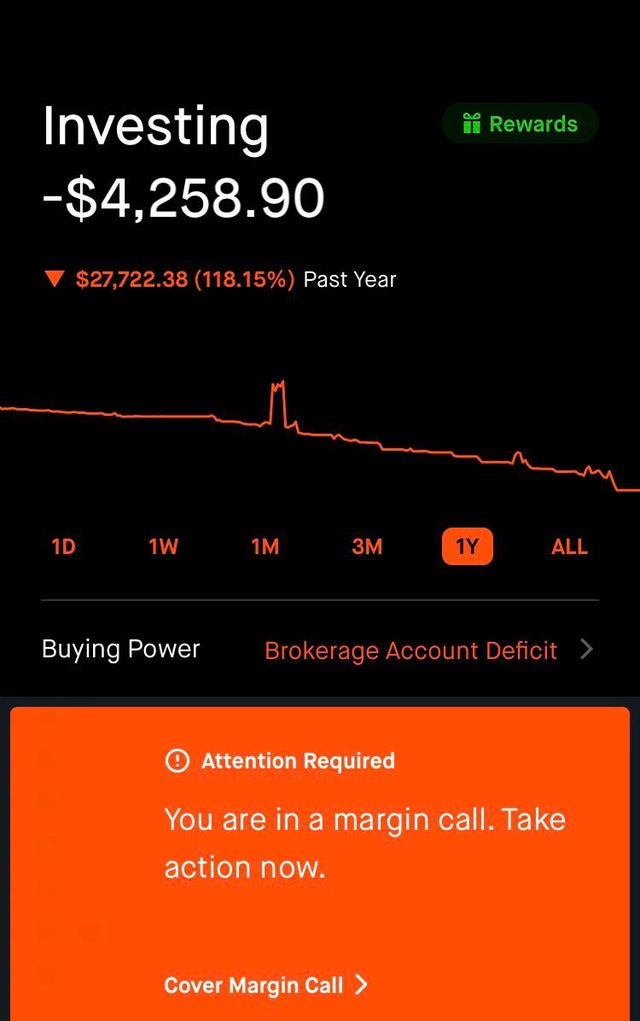

Four years ago, in 2018 this man was convicted and sentenced to seven years in federal prison for several counts of securities fraud.

His name?

Martin Shkreli

(In case you don’t know who he is I would highly recommend watching this video by Youtuber Benjamin.)

One month ago (at the time of this writing), on May 18 he was released from prison on account of completing all programs necessary to shorten his sentence.

Martin Shkreli was more than just a polarizing figure, he was, for the most part downright hated. He was most notoriously known for increasing the price of the drug Daraprim from $13.50 to $750 overnight.

Regardless of what I or you personally think of Shkreli, there is something to be noted about him.

He was loved by the Reddit community on r/wallstreetbets.

You know, the community that took on the hedge funds in the Gamestop fiasco at the beginning of 2021.

AND, since he was a biotech company executive, he definitely knew what he was talking about when it came to the industry. He provided his insight into the industry for free on the forum. He has been known for being risky with his investments so much so that he blew up a hedge fund. However, he managed to call both Bitcoin and Tesla before their huge run-ups in price, as well as some bio-tech calls.

Martin Shkreli is not the point of the post, but I figured since we’re covering r/wallstreetbets today that I might as well mention it since he posted on Reddit yesterday (also at the time of this writing).

His username is u/martinshkreli if you’re interested in following him.

Now Into The Focus Of This Post

r/wallstreetbets…

A subreddit dedicated to, gambling? Or maybe investing? It’s unclear whether they would prefer a multi-million dollar winning trade or a soul-crushing loss for Reddit clout.

On the other hand though…

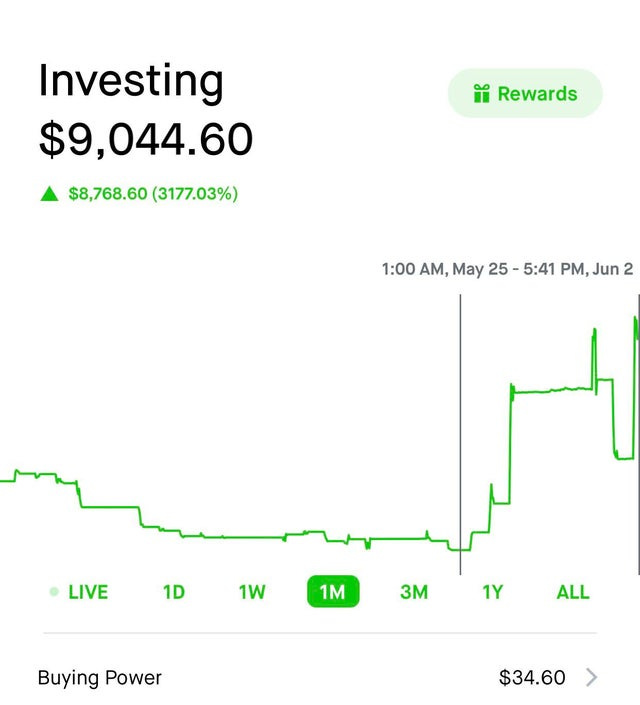

How is it possible to even make +3100% on a single investment?

Over a lifetime of investing if an investor were fortunate enough to make 10% annually without accounting for inflation, they would be just shy of 4600%.

Well, today, our goal is to figure out what causes these insane gains, what’s the probability of achieving one, and as always, can we replicate it?

So What Exactly Is Even Going On Here?

Well from the looks of it, these kinds of returns are really only possible using options. Options give us leverage by allowing us to control hundreds of shares with a single contract. In fact, according to nasdaq.com call options allow for a 100:1 leverage ratio.

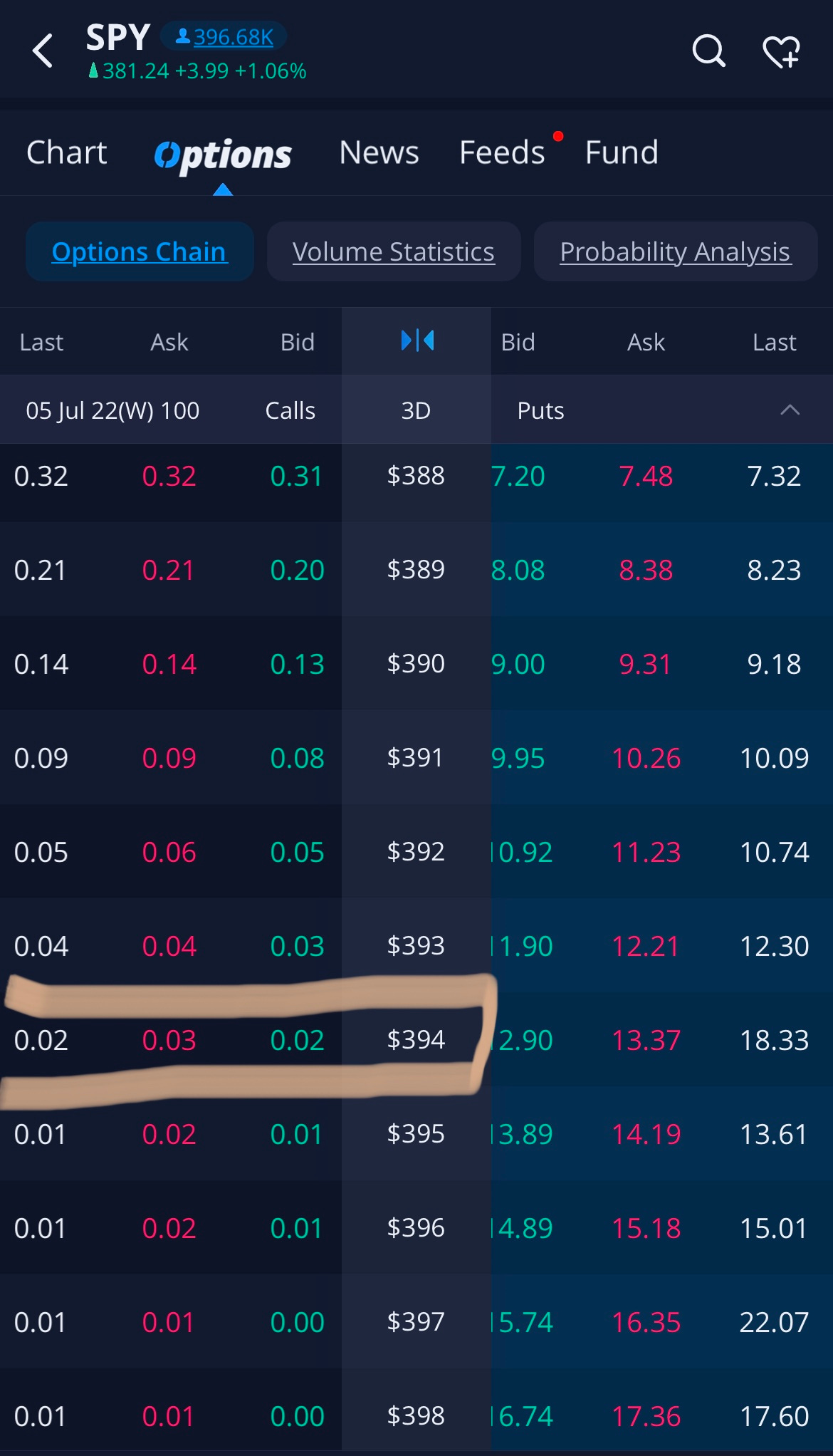

With r/wallstreetbets in particular, they are purchasing zero-day to expiration, out-of-the-money options. When it comes to options this is probably the riskiest of the risky ways to purchase them.

Out-of-the-money options are ones that have zero intrinsic value. No one would want to exercise an option allowing you to buy a $50 stock for $100.

Zero-day to expiration options are risky because of something called “option theta.” Theta basically measures the decay of an option premium over time. By definition, theta on the day of expiration of an OTM option is the entire premium of the option contract. By the end of the day, the contract will be worthless unless the underlying stock price crosses the strike price putting it in the money for the option.

These options are highly sensitive to the underlying stock price as every passing hour chips off a piece of the premium, and any favorable movement moves the option closer to the desired state of being in the money.

But… with high risk comes possible high reward, as we saw in some of the earlier screenshots.

For sake of simplicity, we'll assume we are looking at a 0DTE option with an option delta of 0.01. This delta pretty closely correlates with the probability of expiring in the money (1%).

So hypothetically, one out of every hundred trades we do like this will result in the option expiring ITM.

Again, here we’re going to make another assumption for sake of simplicity. Options have something called extrinsic value (the value of an option that is beyond what it could be exercised for) and intrinsic value (the value you get by exercising an option). Ex: A call option that costs $1.20 per share with a strike price of $100 has $1 of intrinsic value if the underlying stock is at $101. The remaining $0.20 of value can be attributed to extrinsic value because it is value above what the option could be exercised for.

Now the assumption we’re making to simplify this is that we hold the 0DTE option all the way to expiration instead of selling it intraday (which leaves us with no extrinsic value and only intrinsic value, if there is any).

In this particular case, there is a SPY call option selling for $0.02 per share ($2 for the whole contract) at the $394 strike price. This call option has a delta of just over 0.01.

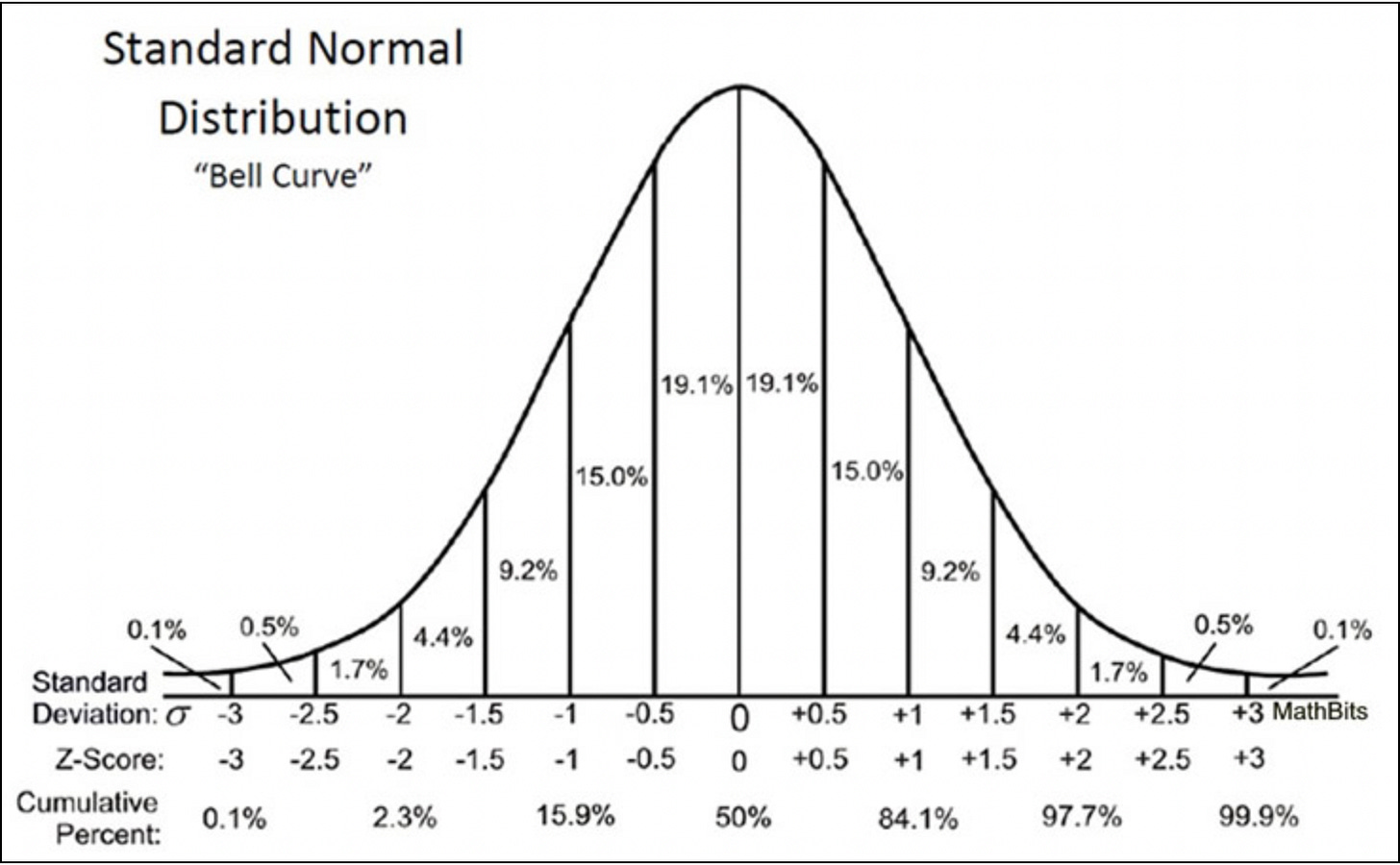

Now using some math from one of my previous posts we can calculate the probability that this option ends up significantly ITM. For SPY in this example, the standard deviation is calculated at 0.022 (or $8.709). So for the first standard deviation, we end up at $389.95. That’s still too low, so let’s check out two standard deviations. Two standard deviations give us $398.65. That is way in the money (with SPY being at $381.24 currently), so exactly what we were looking for. Based on the way that standard deviations work:

It is safe to conclude that there is only a 2.3% chance that SPY will hit $398.65 by option expiration. At $398.65 there is $4.65 of intrinsic value on the option per contract.

So…

We purchase an option for $0.02 per share (which will cost us $2 total) which according to its delta has a 1 in 100 chance of ending in the money. But the implied volatility tells that there is actually a 2.3% chance of the stock hitting $398.65 which is way in the money. Which if the trade pans out, is a 23,150% increase in our invested capital. What’s odd is that the probabilities of having a positive outcome do not line up. However, in either scenario (the 1% or 2.3% chance) there is a positive expected value. Over a long enough time frame, it would appear that this strategy could make money.

Although I’ll say, that I have a hunch that somewhere, there is something unaccounted for, the market doesn’t generally like handing out money this easily. Because the options are so cheap, it couldn’t hurt to try the strategy out with a couple hundred dollars and see if it works, but this is definitely a topic I would like to revisit with the expertise of someone more experienced than me.

But… now that we’ve done the math, let’s just assume we are wrong and that there is a negative expected value by executing this type of trade hundreds of times. If we were to try our hand at speculating, what would be the best strategy?

Well, the best strategy is the same that you would use in a casino when you have a negative statistical edge. Play with small amounts of money, and if you win, stop playing! Any gains you make would just be a matter of luck, and therefore it would be best to quit before the negative edge is able to take away your winnings.

And remember, as Warren Buffett would say:

In my view, derivatives are financial weapons of mass destruction

If you liked this article, please take a moment to subscribe or share it with a friend! It really helps me to continue writing this content. Thanks for reading!

All content is for discussion, entertainment, and illustrative purposes only and should not be construed as professional financial advice, solicitation, or recommendation to buy or sell any securities, notwithstanding anything stated.

There are risks associated with investing in securities. Loss of principal is possible. Some high-risk investments may use leverage, which could accentuate losses. Foreign investing involves special risks, including a greater volatility and political, economic and currency risks and differences in accounting methods. Past performance is not a predictor of future investment performance.

Should you need such advice, consult a licensed financial advisor, legal advisor, or tax advisor.

All views expressed are personal opinion and are subject to change without responsibility to update views. No guarantee is given regarding the accuracy of information on this post

Opinion-

In your part about modeling the likelihood of an OTM spy option goes ITM, you are assuming SPY follows a normal distribution. I think this is where the disconnect comes from with the positive expected value because that underlying assumption probably is not correct.

Also, 0.02 is the bid price. You won't get filled buying that option for 0.02, rather the asking price of 0.03. Although the difference is small, it's 50% more expensive than in your calculation. While "last" does say 0.02, it could be someone selling a call at the bid so it's not a safe assumption you can buy this option for 0.02